When you are hit by another driver, you expect their insurance company to cover damages to your vehicle and your medical expenses. But what happens when the driver has no coverage? Uninsured motorists costs Texans millions of dollars each year, so what can be done?

Drivers in Texas are required to carry basic liability car insurance coverage. The law requires “the motorist or operator of a vehicle to provide evidence of financial responsibility.” More specifically, Texas drivers must carry liability insurance that provides $30,000.00 of coverage for each injured person, up to $60,000.00 per accident.

Under a 30/60 policy, the maximum amount that an insurance company will have to pay is $60,000.00 regardless of the number of people injured in the car accident. Additionally, a driver in the state of Texas must carry $25,000.00 in property damage coverage. While this amount is usually sufficient in a two vehicle car accident, such amount is usually not enough when there are more than two cars involved in the crash.

20% of Texas Drivers are Uninsured

According to the Texas Department of Transportation, approximately 80% of drivers in Texas carry at least the minimum amount of coverage. However, 20% or one-fifth of the driving population does not carry insurance. Meaning there are over 3,000,000 individuals in the state of Texas driving with no insurance.

Even with extensive penalties that can result in fines of more than $1,000 and license suspensions, it is estimated that more than three million drivers in Texas are uninsured. There are countless stories, like this example from Nicole DeAngelis, where recovering damages is next to impossible.

“Named Driver” Insurance Policies Compound the Problem

Though there are minimum insurance requirements in Texas, the state also allows insurers to offer “named driver” insurance policies. These policies have further exasperated the uninsured problem in the state of Texas. Under a named driver policy, only the drivers named in the police are covered while driving the car.

So if a named driver policyholder loans his or her car to their 17-year old child and the child causes a car accident, the coverage does not apply to the accident and the person not at fault for the collision is left holding the bag.

Do Texans Realize the Extent of the Issue?

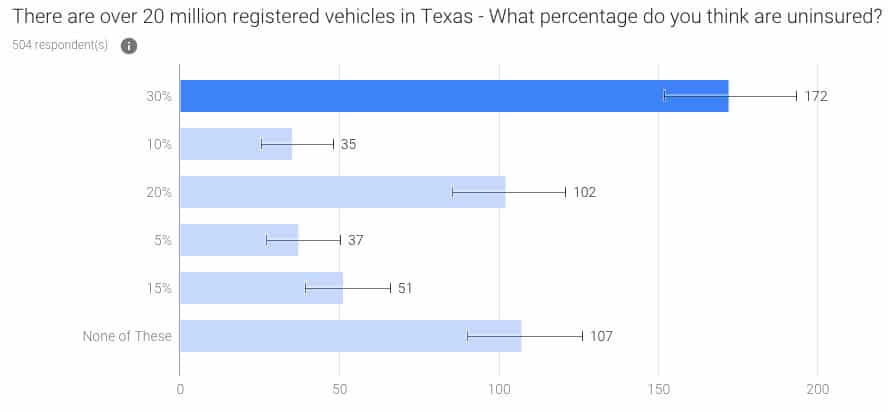

We wanted to find out if Texans realized how many people are driving in Texas with no insurance, so we asked. Check out the results of our poll below.

It turns out that many Texans are aware of just how prevalent Texas’s uninsured driver problem is. In fact, a plurality of respondents guessed that the percentage of uninsured vehicles in Texas is 30%, 10% higher than the actual percentage.

Driving without Insurance is Not a Victimless Crime

The people who have been in a car accident with an uninsured driver have experienced first-hand the problems created by uninsured drivers. By way of example, if you are hit by an uninsured driver and you only have liability coverage then you will not be able to get your car repaired after the accident unless you pay out of pocket.

Also, if you have medical bills, you will have to pay those bills yourself or put your credit at risk. Getting hit by a driver with no insurance is a significant problem, but it is a problem you can protect yourself against.

So what can be done?

TexasSure

TexasSure seeks to identify vehicles on Texas roadways with no insurance.

The system uses a database connecting registered vehicles, vehicle identification numbers, and liability insurance policies. Law enforcement in Texas can access the system upon request and determine if someone is driving with no insurance.

The database is a great start, and the final goal is to eliminate uninsured drivers from Texas roads, but that won’t happen overnight.

In the meantime, taking steps to protect yourself is crucial.

Un/Underinsured Motorist Coverage (UM/UIM)

Protecting Yourself Against Uninsured Drivers

Though the state of Texas does not require UM/UIM insurance coverage, it’s a good idea to add it to your policy. With approximately 20% of drivers in Texas with no insurance, there is a significant risk to being hit by one of them. If you are hit by an uninsured driver, a basic liability insurance policy won’t cover the accident. Meaning you will be responsible for your property damage, your medical bills and any other damages you sustained.

Most folks buy a basic liability policy because it is a few dollars cheaper. This is a bad decision that could cost you greatly if you are involved in a car accident with an uninsured driver. With UM/UIM coverage, you are protected. This type of insurance covers you when you were hit by someone with no (or not enough) insurance, or by someone who fled the scene and was not located.

Protecting Yourself Against Underinsured Drivers

While uninsured drivers are a big problem, another significant issue arises when there is not enough insurance after a car accident because a driver is underinsured. Thankfully, the majority of car accidents are minor in nature in terms of property damage and injuries. However, as we all know, some car wrecks can result in significant injuries and life-long complications.

In these situations, if the at fault person has a basic 30/60 policy the most an injured person can recover is $30,000.00. However, if you have UIM (under insured motorist) coverage, you can also make a claim against your own insurance company to help cover your damages.

Our Suggested Insurance Coverage

At Sutliff & Stout, we recommend carrying 250/500 coverage on both liability and UM/UIM. Also, we recommend that you purchase an umbrella with at least an additional coverage of 1 million. Assuming you have a relatively incident free driving history, this type of policy will not cost you that much more and the umbrella will only be a few hundred dollars a year.

If you don’t have this coverage, or you aren’t sure, we encourage you to call your insurance company today. You may be pleasantly surprised by the cost – UM/UIM is typically quite affordable. The extra few dollars per month will be well-worth it in the event you’re hit by an uninsured driver.

What Can You Do if You’re Hit by an Uninsured Motorist?

- First, check your own policy. If you have UM/UIM coverage, things are going to be a lot simpler. You’ll file a claim with your insurance company and let them investigate the facts. Beware however – your insurance company may try to avoid paying the claim and, thus, it is always a good idea to speak with an experienced Houston car accident attorney.

- If you have no UM/UIM coverage, the case becomes much more difficult. Again, you’ll want to consult with an attorney. You’ll need to conduct an investigation to ensure that the other driver actually has no insurance, and that they don’t just have an insurer denying coverage for invalid reasons.

- Recovery in cases were there is no insurance is extremely difficult for a number of reasons. First, most folks who don’t carry insurance do it because they don’t have the money to pay for insurance. If a person can’t afford insurance then they probably don’t have the money to pay for your damages and resulting injuries. Second, under the state Constitution, the most common assets are protected from a judgment such as a person’s home, car, and retirement account. This means even if you get a large judgment you don’t have the ability to collect any money for the at fault party because everything of value is protected. Third, most lawyers are aware of the problems presented by no insurance and, thus, they will not be willing to take on the case so you will likely be going at it alone..

The most important thing you can do as a Texas driver is protect your own interests. The best way to do this is to make sure you have sufficient UM/UIM coverage on you, your family and your vehicle. Dealing with the aftermath of an accident involving an uninsured driver is stressful and frustrating. By having a little bit of foresight, you can largely mitigate the issue.

- What Are Texas Motorcycle Permit Restrictions? - April 13, 2024

- Do I Need Motorcycle Insurance in Houston? - April 11, 2024

- Moped Laws in Houston - April 10, 2024