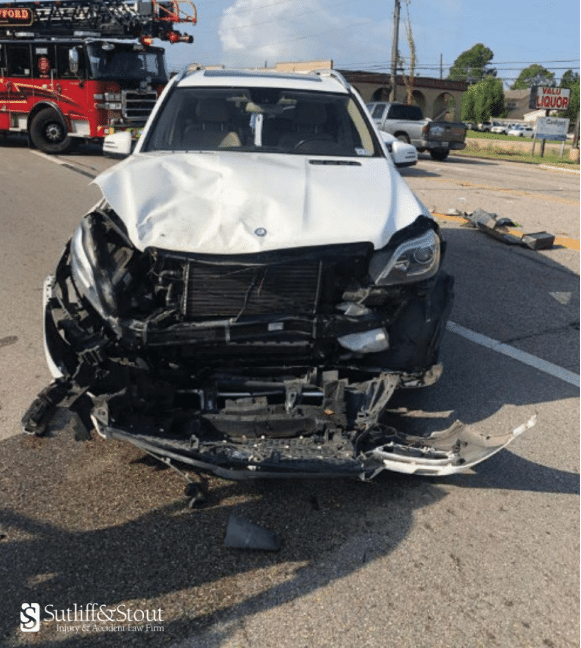

Having never been in a car accident before, I assumed the insurance company for the 18-wheeler would take care of everything, and do so honestly. I was wrong. The insurance company refused to help me with my medical bills and wouldn’t treat me fairly. That’s when I contacted Sutliff & Stout. Thankfully, they stepped into the picture and made sure that I was treated fairly and with respect. These guys are tireless and fierce advocates for their clients. Sutliff & Stout provided clear explanations at every step, outlined my options, and carried out any decision I made. I was very fortunate to have found this firm.

How much do you charge?

Ask about the attorney’s fee structure, including their contingency fee percentage and any additional costs you might be responsible for. A reputable lawyer will clearly explain what percentage they’ll take from your settlement and discuss potential medical liens or case expenses, ensuring no financial surprises when your case concludes.

(713) 405-1263

(713) 405-1263  550 Post Oak Blvd, Suite 530

550 Post Oak Blvd, Suite 530